I shouldn’t be surprised.

Today, I accepted a meeting with someone who said she was an entrepreneur starting in the security space. I thought she was honestly trying to do homework as she started her fledgling business. My hope was to be able to share our journey and experiences.

Now, I just feed duped.

This person was just one of the plethora of private equity companies that cold reach out to purchase companies like ours. On the surface, they claim to be “entrepreneurs,” but I disagree. My personal description of an entrepreneur closely matches that of the Cambridge dictionary.

“someone who starts their own business, especially when this involves seeing a new opportunity”

Entrepreneurship is about starting a company is hard. You have to do serious work and the road is risky. Small businesses fail at an incredibly high rate:

- 20% within the first year

- 50% in 5 years

- 65% in 10 years

It takes a very special, dedicated person to create, build, and run a company. Often, (but admittedly not always) entrepreneurs have a great love of what they do and the people in the company they start.

In my book, these private equity firms are not true entrepreneurs.

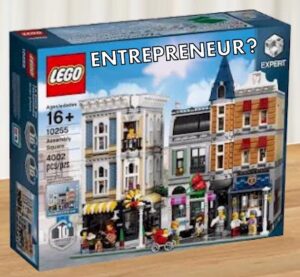

I liken entrepreneurship to building with Legos. An entrepreneur creates their business from whatever Legos are available. It will be messy as they learn to connect the pieces at their disposal. Private equity wants the Lego build complete, so they can realize its value and monetize it.

Private equity companies are investors looking for opportunities. They do not create. Their love and goal is money – not in bringing an idea to life. Their financers have no interest in the risk inherent in being an entrepreneur and will walk away if the probability of failure is too high. They certainly have no love of the business or the people working in it. Private equity is very rational about the value of companies – entrepreneurs can often be irrational. And who can blame them? They are building a dream.

On the flip side, I do think that private equity does have a place. They likely provide financial exits for business owners in need of it. Certainly, most companies can also benefit from disciplines they bring that improve efficiency, connect with strategic partnerships, and provide better management structures as they work to move the company to greater profitability.

But improvements are not creation. And buying a business does not make one an entrepreneur.